It’s is a normal response that is natural and truly a good question.

Makes perfect sense. Why would I acquire a new money that I cannot use anywhere?

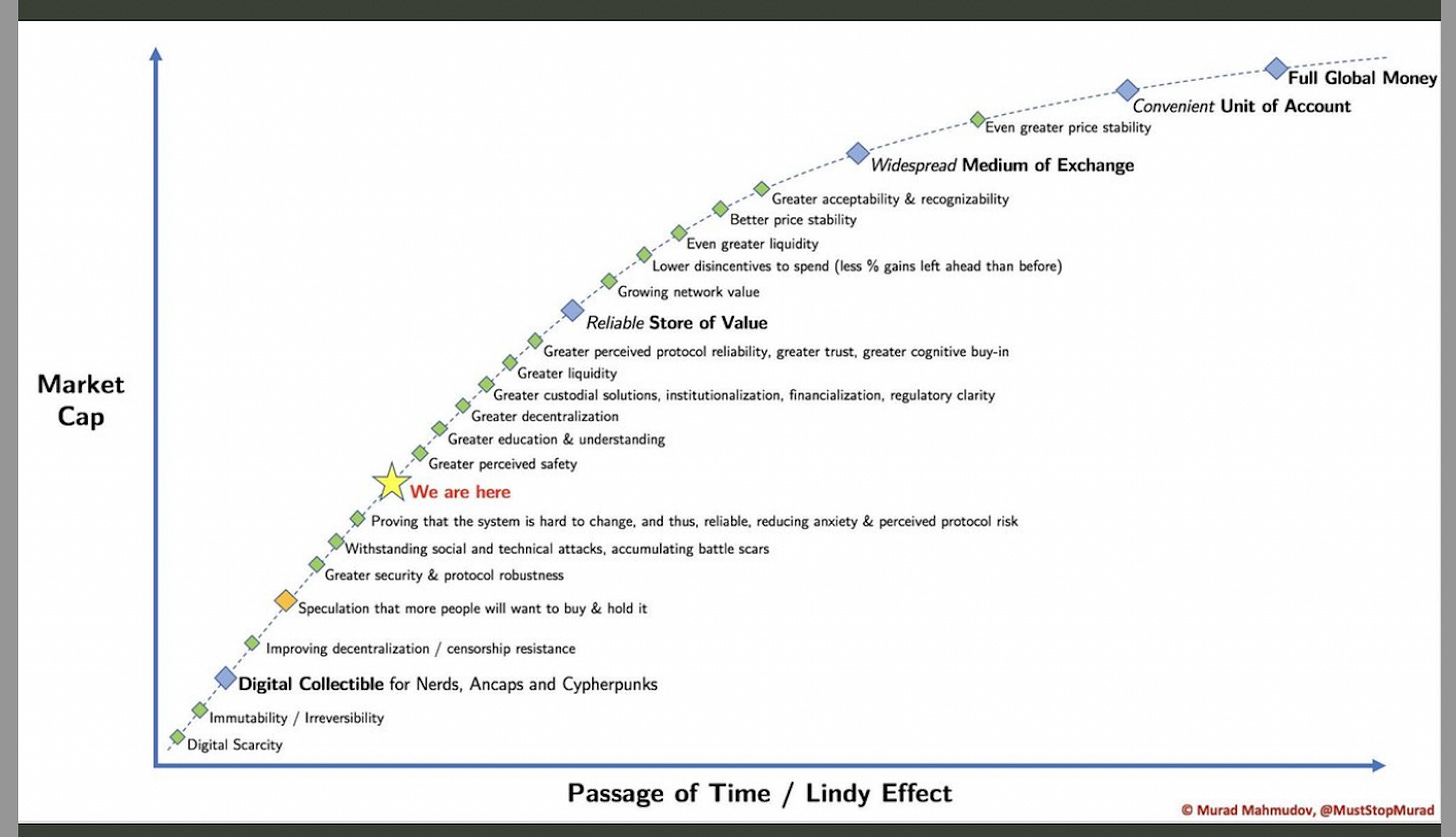

First off, just to keep things straight, new monetary assets become stores of value first.

Then once it reaches critical mass then it becomes a medium of exchange and a currency once majority of people are using.

However, because Bitcoin is digital and so easy to use it’s already being used all over the world and adopted as legal tender in places like El Salvador or CAR.

This will increase over time as adoption continues and game theory plays itself out.

If you are hungry or thirsty or need something for your life then you would surely spend your bitcoin, no?

Someone who is very wealthy and continually making more money (that kept going up in value) would still want the yacht or super car, no?

This argument doesn’t hold up because people aren’t incentivized at this moment to spend their money because the inflation rate isn’t egregious enough yet in developing countries.

Evidenced by the fact that majority of people still think they can save fiat dollars and get ahead in life.

So a currency constantly losing value each minute of each day (at lower inflation rate) isn’t moving the needle on getting people to rush out and spend their cash.

So why would a currency/money going up in value be bad?

People generally want to save capital and this aligns incentives. Humans already have a penchant for saving capital. Now they are rewarded for that act.

Then once they feel like they have enough saved (and realize the rest of their capital saved up is still increasing in purchasing power) they will obviously spend it.

They know they will make more plus what they have saved is still going up.

Disenfranchised with politics?

It’s not red versus blue, it’s the state versus you.

Vote with your money is something EVERYONE can do.

If you are out of the legacy monetary network then it loses its value over time and the more people do it, the faster it dies.

The faster it dies, the quicker the adoption of the best technology will win.

It is kind of like when MySpace came around and became a big internet sensation. Then Facebook came a few years later and took over and MySpace faded in to the sunset.

Facebook had much better product and network effects so everyone migrated to that system within 10 years.

Only difference this is money and not just a social media site. Facebook didn’t have governments trying to stop it.

People say that bitcoin cannot be used anywhere.

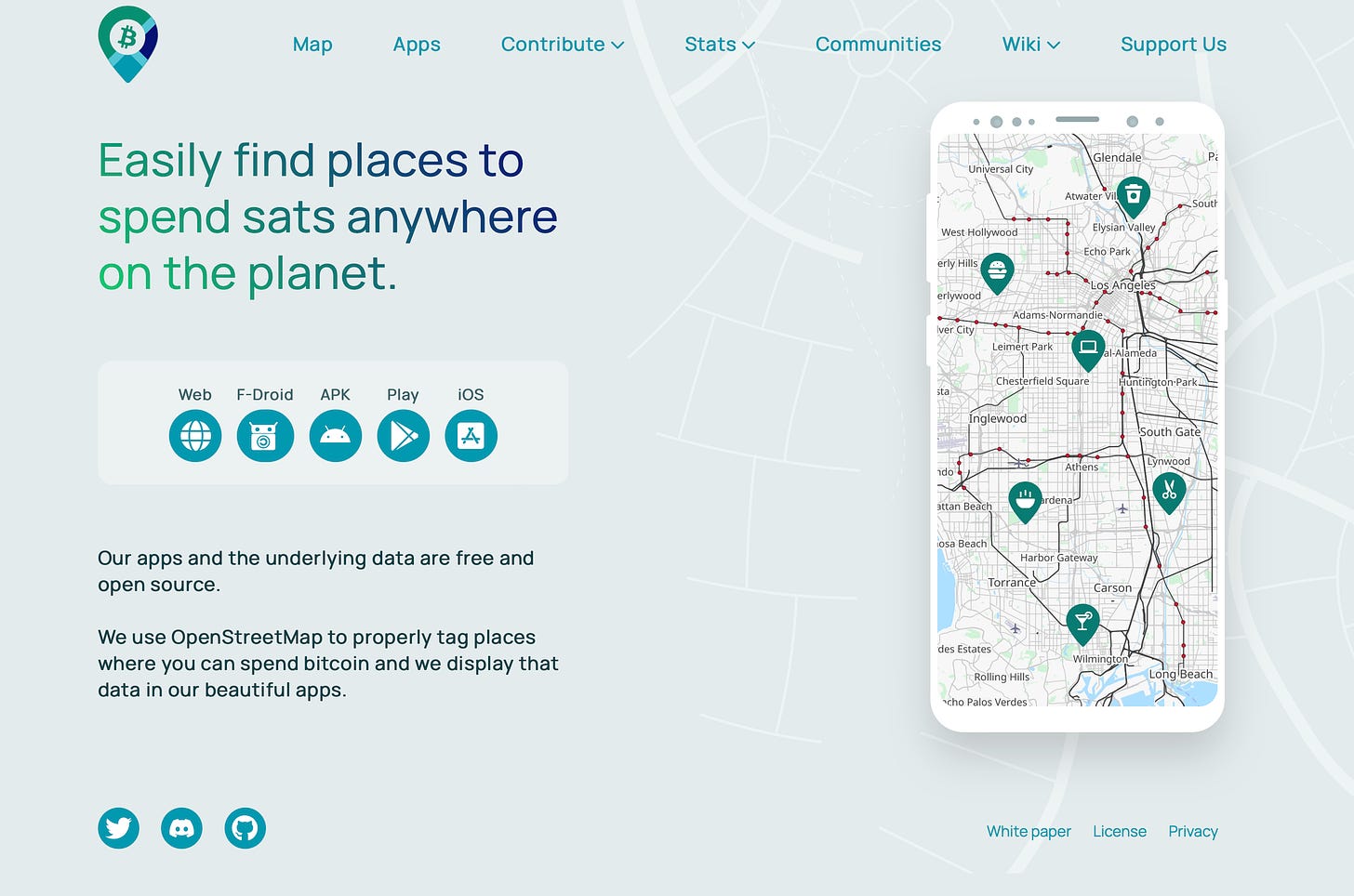

That is untrue, it can be used at thousands of businesses all over the world directly and growing by the day. Go to BTCmap.org for a map of many businesses around the world accepting bitcoin. You can even add to it.

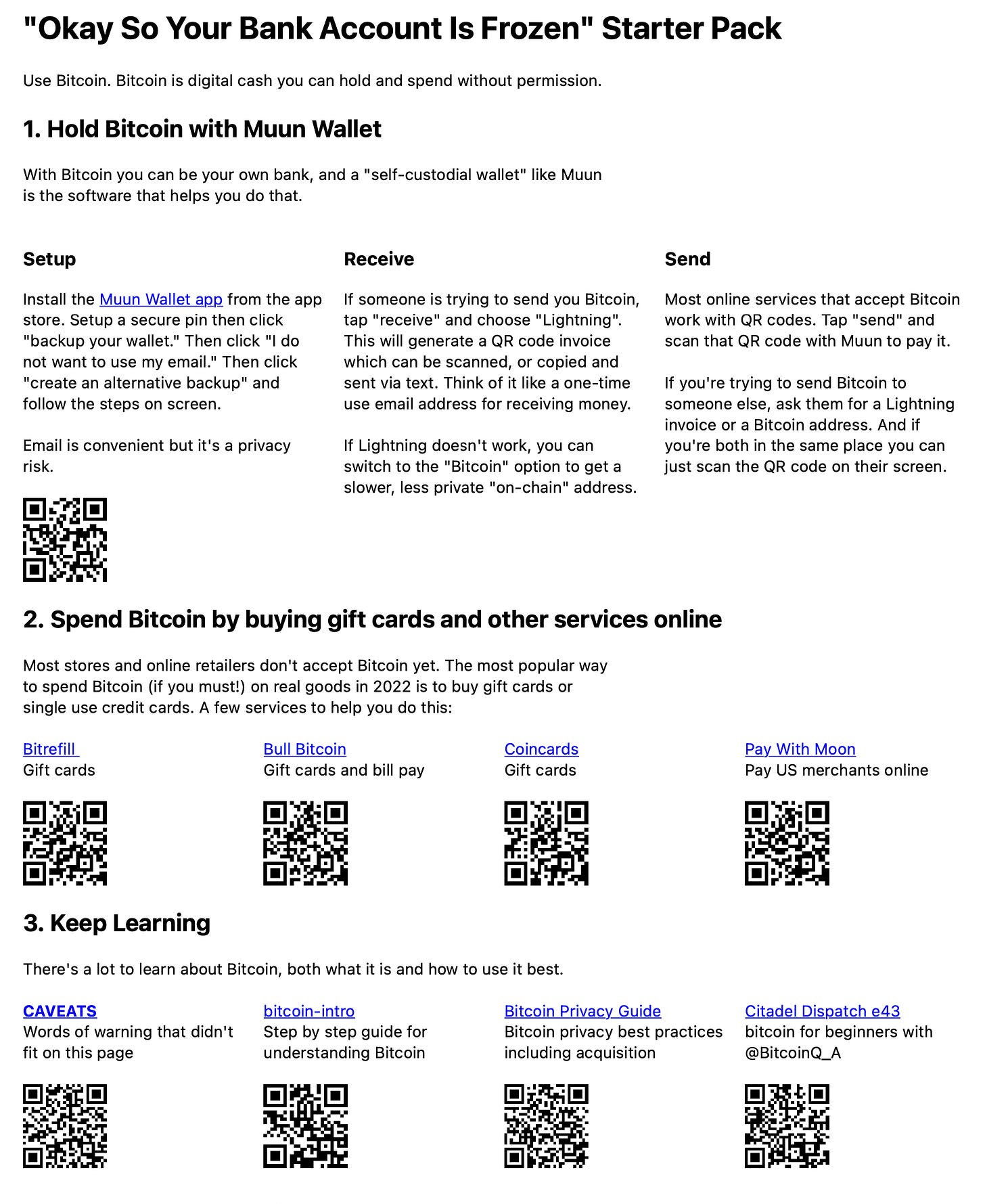

Or you can use your bitcoin to buy fiat gift cards/debit cards to use in the fiat system all over the world at almost any place you would normally spend money. Or pay bills.

Bill Bitcoin

Coincards

Bitrefill

Pay with Moon

Whatever you want to spend money on, buy bitcoin first and then spend it.

Or buy with bitcoin and then replace quickly with bitcoin.

The cool part is you can usually do this anonymously because of the lightning 2nd layer on top of bitcoin’s 1st layer protocol.

The super cool part is paying in bitcoin many times will give you a discount on your items you purchase like you see if someone is paying in cash.

More companies are springing up like crowdhealth where you can crowd fund healthcare services with people who think alike. While not throwing away your premiums every month.

Now you can save half of your premiums each month in bitcoin, in accounts, that you control so that you benefit unlike the traditional system where the care gets worse and your premiums are gone to your insurance provider.

People get so focused on the price of bitcoin and fiat dollar terms that it scares them out of the new monetary system being built in parallel to the legacy crumbling fiat system.

Shift what you were looking at instead of fiat price, but instead in terms of freedom and value being created on this new open network monetary standard.

Stay strong,

Source link

Author Brandon Gentile