(Part 1 of 3 special to Bombthrower by digital asset space analyst Scott Hill)

On November 2nd Coindesk published a leaked balance sheet from FTX affiliated market maker Alameda Research.

Ten days later the third largest Crypto exchange in the world was bankrupt and its founder was under international investigation for fraud.

In this article I’ll go through how Crypto giant FTX fell apart. There is a lot of backstory to this situation which I’ll cover in a following article, discussing the beginnings of Alameda research and the story of how a sketchy hedge fund turned into a major exchange.

As you’ve no doubt heard repeatedly this week, self custody of your Crypto is the safest approach until we know who is insolvent and the extent of the contagion. If you’re not confident with self custody, Coinbase and Kraken seem to be the safest Crypto exchanges, but that is still a counterparty risk that I’m not willing to take personally in these market conditions.

The Balance Sheet Leak

The exclusive scoop from Coindesk looked bad for Alameda Research. The firm, which performed market making on FTX as well as taking directional bets and venture capital investments, seemed insolvent on a realized value basis.

Their balance showed $14.6 billion in assets held against $8 billion in liabilities. On paper solvent on a mark-to-market basis, but digging in there was no way that mark was reasonable.

The most egregious example was $5.82 billion worth of FTT tokens on the asset side, around a third locked and the rest unlocked and available to trade. FTT is a token created by FTX, a sort of pseudo-equity token which represented some share of the exchange revenues. Kind of.

FTX had been doing periodic buybacks of the token which were supposed to represent a distribution of exchange revenues to holders. Holding the token also entitled traders to a discount on trading fees. The token was at the time worth around $26. At its peak it was worth around $80.

The main thing that FTT was used for though, was pledging as collateral by FTX and Alameda.

You read that right, a token which the exchange invented a little over 3 years ago was used as collateral for loans. We know for sure that it was acceptable collateral in various Solana DeFi protocols, which FTX had a significant amount of influence over; but reports are also surfacing that it may have been used to purchase real estate in the Bahamas and quite possibly with various institutional Crypto lending like Genesis which is now facing major problems.

The problem with FTT

There’s nothing inherently wrong with using Crypto tokens as collateral if there is a robust and deep market pricing them. If the loan goes bad, lenders can seize the collateral and sell it off, covering some of their loss.

FTT didn’t have a deep and robust market.

There was barely any volume. There was barely any liquidity. If a lender had to sell a large volume in a hurry there weren’t any buyers ready to step in.

While Alameda was claiming to have $5.82 billion of its balance sheet held in FTT tokens, the entire available market cap was less than $4 billion.

Read that again, Alameda’s balance sheet held more than the entire market cap of FTT.

So this wasn’t a situation where a lender might make a loss on selling the collateral, this was a situation where there were potentially billions in loans floating around in the Crypto ecosystem with essentially no collateral that could be liquidated without detonating the market.

Just to top it off, some of this FTT was likely pledged to multiple lenders.

Industry Reaction

The initial reaction was general indifference. Alameda looked like it was playing with fire and had gone all in on the exchange token for its sister company FTX alongside various other FTX supported coins like Solana and Serum. It was an open secret in the industry that Alameda and FTX were more intertwined than they claimed, but if push came to shove it was assumed that Alameda would be allowed to fail and FTX would continue being the highly profitable exchange that everyone assumed it was.

FTX was highly profitable, right?

There were a few that were calling the bluff, but the main gripes were conflict of interest within FTX related companies and unsavory business practices by FTX, trading against customer positions and liquidating accounts improperly. The usual bucket shop tricks. No one seemed to be expecting a total insolvency across the FTX group of companies.

But still something didn’t feel right. Caroline Ellison, the newly appointed CEO of Alameda Research tried to calm fears on Twitter, claiming that the leaked balance sheet was only a partial balance sheet, there were another $10 billion in assets elsewhere within the corporate structure, and they’ve paid down most of their loans.

It was a strange and deeply unsettling response, shrugging the issue off as if the industry should just take her at her word.

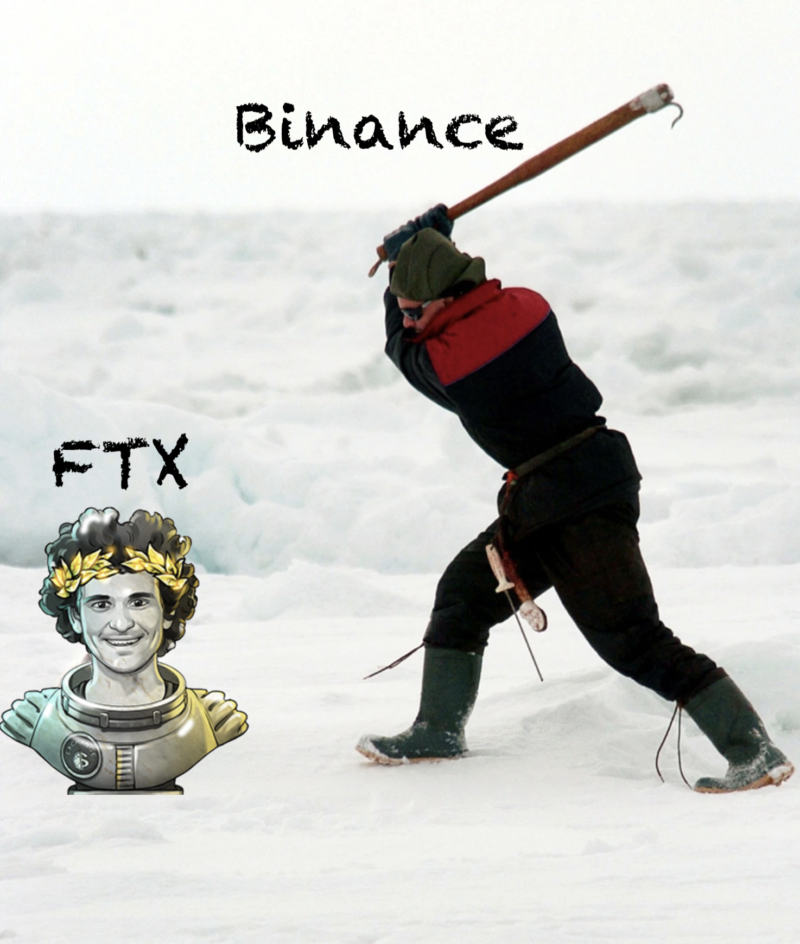

Enter the CZ Dragon

Even CZ, the CEO of rival exchange Binance, didn’t seem to be suggesting that FTX was in trouble. Late on Sunday November 6 CZ announced that he would be liquidating the FTT held by Binance.

All $500 million of it.

Binance had been the sole investor in the seed round for FTX. In 2021 they were bought out for $2.1 billion in cash and FTT tokens. This alone wasn’t enough to push markets into panic. CZ said he would do this over a number of months, carefully and slowly in an attempt to “minimize the market impact”. In a follow up tweet, CZ said that he was doing “post-exit risk management, learning from Luna”

Everyone in Crypto knew what he meant by “learning from Luna”

In May Luna detonated, dropping to zero. The protocol is now seen as a deeply flawed project in the best possible light and a blatant ponzi scheme in the more realistic assessment.

Did CZ, the most powerful man in Crypto just call FTX a ponzi scheme?

Panic

Crypto industry figures were in disbelief. Surely FTX, the darling of the industry, was a highly profitable, solvent and legitimate business. But the reaction was off and deeply troubling. The CEO of Alameda Research quickly asked CZ if she could buy all of the FTT tokens off-market at a price of $22.

The market smelled blood.

Over the course of the next few hours FTT was aggressively shorted, Caroline had put a floor under it at $22 and traders were going to bleed Alameda dry defending that mark. Why did $22 matter? It’s only conjecture, but it seems likely that below $22 Alameda would be liquidated by its lenders and a cascade of FTT tokens would need to be sold into a market unwilling to buy them, flattening the firm.

But traders only thought they were going after Alameda, the predatory market maker.

In hindsight it’s obvious, you shouldn’t short an exchange token to death on the exchange that issued it, but FTX was the main venue for the fight for $22. A huge amount of volume flowed through the order books and everyone was looking forward to getting paid as the token dropped, first to $18 and later to $6.

While the traders were battling it out, regular users were getting out.

FTX experienced massive outflows and on-chain analysis showed some deeply troubling signs. Alameda was pulling liquidity from everywhere. Every dollar that was deployed in DeFi got pulled. Weird tokens got dumped. But the liquidity wasn’t going into Alameda’s wallet, it was going into FTX wallets to pay customers.

Surely FTX wasn’t funding customer withdrawals from Alameda’s DeFi degen positions?

FTX was supposed to be a full reserve exchange. As an even higher bar, the terms of depositing with FTX were that customers retained title to their assets. Assets were held on trust, they weren’t supposed to be lent out or touched except as directed by the customer.

SBF concedes

On Sunday afternoon, Sam Bankman-Fried (SBF), the CEO of FTX said that the problems with the Alameda balance sheet were just “unfounded rumors”. He explained that FTX had processed billions of dollars in withdrawals and that they would continue to do so. He claimed that they were hitting node capacity, something that I’ve never heard of, and needed to slow down withdrawals.

By Sunday night, withdrawals of some assets had stopped entirely, but there was no announcement from FTX. Radio silence from the team.

We now know that during this period SBF was frantically going to investors to do an emergency fundraise of between $6-10 billion dollars. The terms which later leaked were insane. It was obvious that no lawyer had reviewed these documents.

They seemed to be written by a child, imitating a businessman, who was in way over his head.

Industry insiders at the time thought that FTX had likely lost some amount of user funds, would need to take a loan to cover them and could move on with rebuilding trust. We were shocked to wake up on Tuesday to the news that Binance had made an offer to buy out FTX entirely, subject to due diligence. This isn’t what a rescue package for a competently run business looks like.

This was a fire sale of a dumpster fire.

The previous day SBF had claimed his exchange was fully solvent, just having minor liquidity issues. The next day he was handing the keys to their main rival. Now that balance sheets have been leaked for FTX we know what Binance would have seen as soon as they started their diligence, a balance sheet crammed with dodgy tokens and full of holes, unaudited and put together in excel with no real supporting evidence.

The rumored sale price was one dollar.

CZ quickly walked away from the deal, citing misuse of customer funds and regulatory concerns; leaving SBF to fix his own mess. With the exchange still operational, but withdrawals closed, SBF posted yet another long thread trying to talk his way out of the problem, claiming to be trying to set everything straight and get emergency funding. While he had not yet admitted that it was all over, he did make a bizarre reference to CZ “well played; you won”

As we came to learn later, for this sociopath that’s all it was, just a game to be won or lost.

The Insanity Begins

The rejection of the deal from Binance was the first mention of misuse of customer funds. Until then there was speculation that there was a minor balance sheet hole, remember, no one knew at that time that SBF had been seeking $6-10 billion in emergency funding. The next day the news started pouring in.

Reuters reported that there was a secret back door in the accounting at FTX which allowed customer funds to be moved around without alerting anyone. It also claimed that $10 billion dollars worth of customer funds had been secretly moved to Alameda.

SBF remained silent, but elsewhere there was chaos. Alameda funds were moving around frantically on chain, placing gigantic bets and actively trading.

Was SBF trying to trade out of it?

Tether put a stop to this later in the day, freezing Alameda’s funds on the request of law enforcement.

On the exchange the chaos was even worse. Justin Sun the founder of Tron had shown up to offer to redeem Tron tokens trapped on FTX. Prices spiked as customers flocked to get cents on the dollar via this exit ramp. There was talk of taking complicated cross-platform trades to make a synthetic exit ramp.

The Bahamas Loophole

As the insanity deepened, FTX posted on Twitter that they were processing a small amount of withdrawals to customers in the Bahamas as requested by local authorities. A week later we found out this was a lie, there was no request, but even at the time it seemed likely to be a way for insiders to exit their funds before the inevitable bankruptcy.

Suddenly, traders with stuck funds were desperately trying to obtain a fraudulent Bahamian passport and complete identity checks in the Bahamas. Some even managed to do it apparently and successfully withdrew funds. Black market prices on passports spiked and a secondary market for trapped funds emerged, with accounts trading for 15 cents on the dollar.

NFTs were being traded for entire balances in order to move the funds to an account which could still withdraw.

On the actual exchange things were just as chaotic. Traders with trapped funds were treating their accounts like paper money, trading nonsense on high leverage and dislocating markets. FTX was removed from pricing feeds to restore order elsewhere.

This was the first time in the whole saga that it became clear, it was all over for FTX.

FTX US halts withdrawals

This entire time the story had been that FTX US was a separate entity. Their funds were firewalled off from FTX international. The exchange remained open for withdrawals and appeared to be functioning properly.

This relative calm on the US side of the company instilled some faith. Surely, despite the havoc going on in the Bahamas, the US exchange was well regulated. Surely, the books were audited and no client funds could go missing in the US.

On Thursday afternoon, FTX US halted withdrawals.

Bankruptcy and the Hack

On Friday morning SBF resurfaced and announced that FTX would be put into bankruptcy. The motion was filed in the US and included FTX US. It would later be revealed that SBF had stepped down as CEO and John J Ray III, a lawyer famous for taking over Enron post-collapse, would be similarly guiding FTX through bankruptcy. Everyone breathed a sigh of relief, it was finally done.

But the fun and games weren’t over

Shortly after the bankruptcy was announced funds started moving on-chain. A lot of funds. Over $600 million left FTX affiliated wallets, moving to fresh wallets. The speculation was that there was a hack, perhaps by an insider looking to get the last of what they could out of FTX.

It quickly became clear that there were two teams working. One appeared to have simply moved worthless tokens into storage, a plausible move by a “white hat” or good guy team seeking to preserve user funds from a compromised system.

The other team, the “black hat” team, took the vast majority of the $600 million and moved it all into Ethereum DeFi, trading other coins into Ethereum tokens and consolidating them all together. This consolidation took place across multiple blockchains and traded with reckless abandoning, losing gigantic sums on slippage along the way.

Once the dust had settled, the hacker was one of the largest individual holders of Ethereum.

We don’t quite have the full story on what happened here yet. The Bahamian authorities claim that they seized the assets, with many assuming that they are referring to the hacked funds. It seems far more likely that they are referring to the “white hat” funds only, as the “black hat” funds demonstrated much more sophistication in blockchain use that could be expected of a regulator.

The funds have stopped moving for now. Sitting idle with more that 241,000 ETH, a little less than $300 million worth. No one really knows what will happen with these funds.

Where are we now?

After a week of complete mayhem as the exchange fell apart and another week for the adults to take over and begin the clean up we have two competing bankruptcy procedures. One taking place in the US, overseen by the lawyer who cleaned up after Enron collapsed. The other taking place in the Bahamas, overseen by two accountants from PriceWaterhouseCoopers and a senior local lawyer who has a decades long history of high level appearances in the Supreme Court of the island nation.

It’s not entirely clear which action will take precedence, but they are opposed to each other. The US bankruptcy is seeking that all the companies be wound up together and users are compensated with whatever assets are left across the entire conglomerate.

It turns out, FTX was made up of over 100 individual companies.

The organization chart looks like the web a drunk spider would spin. It’s not the sort of corporate structure that would be constructed for anything other than hiding funds and playing shell games.

The Bahamian action appears to be seeking to have the main FTX company dealt with separately, screwing US customers out of funds and leaving the bankruptcy in the hands of the Bahamian government which seems to have taken some pretty significant donations from FTX in the past.

In filings made late this week FTX was referred to as a “disorganized mess”. There was a lack of proper accounting. The auditing was done by “the first accounting firm in the metaverse” that doesn’t appear to have a physical address. There appears to have been loans made to company executives in the hundreds of millions of dollars range. There was no corporate board. There was no human resources department. There was no accounting department. There was no real tracking of customer funds.

The lawyer handling the FTX bankruptcy also conducted the Enron bankruptcy. He says this is far worse.

Enough for now

This is just the walkthrough of how everything fell apart in front of our eyes. The corruption, the lies and the scandal have all been uncovered in the wake of this collapse. In another article coming shortly I will cover the rise and fall of FTX and Alameda Research, delving into the backstory that allowed this fraud to grow under the cover of one of the most well regarded companies in the industry.

Today’s post is from contributing analyst Scott Hill. To receive further updates of this series and our overall investment thesis for digital assets (even in this climate), subscribe to the Bombthrower mailing list.

Source link

Author Scott Hill