Some say how high can bitcoin go? My response is, “how low can the currency go?”

In other words, how much currency will they print and devalue it?

This is why the price of bitcoin can go “to the moon.” Fiat currency and bitcoin price are inversely correlated.

An asset that has absolute scarcity of 21 million versus a fiat currency that can be printed to infinity.

Fiat currency = by government dicate.

Confidence is behind currency. No real value to it other than that. What happens once that confidence goes away? How many more countries need to be sanctioned for that confidence to go away? How many more months of skyrocketing inflation until confidence goes away?

Money itself is nothing. It is a tool.

Money is an incentive to humans. It gives us back our time in the form of stored energy.

The elites are in a rock and a hard place: if they raise interest rates to stop inflation then we can’t service the interest payments on the debt.

If they lower rates to continue inflating their way out to make their debt pile more manageable then we may just go the way of hyperinflation, like Venezuela. Currently where they are eating their own pets because the government destroyed their currency.

Which path will we choose?

Governments have always chosen to print currency and inflate their way out because they don’t have to admit the problem or make hard choices. They can just kick the can down the road for the next guy to deal with.

The next cracks that form in the market will force the Fed back in with stimmies once again and lower rates back down to zero.

All in the name of the “emergency du-jour.”

“Just temporary” they will say.

We know that game all too well…

But, I digresss…

The price of bitcoin can and will most likely be correlated to the speed at which wealth is transferred over the following years from all the other asset classes (as we have seen over the past decade.)

REAL ESTATE: As governments have to pay for their boondoggles they will increase property taxes. Rents will at some point become too much for renters to handle. So rent control is a very real possibility. As society decays the cost to maintain living quarters will increase as people take care of their dwelling less and less. Bitcoin will offer appreciation that real estate will not be able to compete with long term. Plus, you cannot move your real estate from state to state or planet to planet. You can move your bitcoin, however.

BONDS: Why would anyone buy a negative yielding (nominal or real) bond from any government or company? I can buy pristine collateral that will make me 100-200%/year with bitcoin.

LIFE INSURANCE: Why would I hold a policy that is only compounding 4-6%/year? I can lend against my bitcoin just like I do my policy, but its compounding 100-200%/year. Plus there is no counter party and I am not fighting an insurance company over what is mine for a payout.

STOCKS: Why hold an asset with counter-party risk that I don’t manage or control and haven’t studied like Warren Buffett when I can own and asset compounding at 100%+/year? If Warren wasn’t stuck in the legacy system he would have saw this 10 years ago but he benefited too much from the money printer and couldn’t see the forest from the trees.

BUSINESS: Why deal with the employees, overhead, vendors, contacts, financial statements, taxes, bureaucracy, red tape, etc, etc, with business? I can sit back and just save bitcoin and let time do the heavy lifting for me.

COMMODITIES: There is still inflation with gold and silver and other metals/energy as more of it is mined plus there is money I have to spend to keep it stored and protected. Or heaven forbid I have to transfer it somewhere. Bitcoin can be transferred at the speed of light and with minimal fees.

I you are getting concerned with fiat price of bitcoin I would remind you to zoom out and look at the big picture and don’t get caught in day to day or week to week or even month to month price movements.

Also, think about your time horizon and reevaluate why you own bitcoin as an asset in your portfolio.

Are you looking to be a part of something that will change the course of human history and restore many lost freedoms that will happen to go up a lot over the next decade?

Or are you here for a quick buck?

Are you using your bitcoin to obtain more fiat currency (worthless pieces of paper) or are you thinking in terms of using your fiat currency to obtain more bitcoin?

“Bitcoiners” think in years and decades and changing the world. Low time preference humans.

Versus high time preference, where people aren’t thinking long term, and may be sabotaging their future by making shortsighted life decisions.

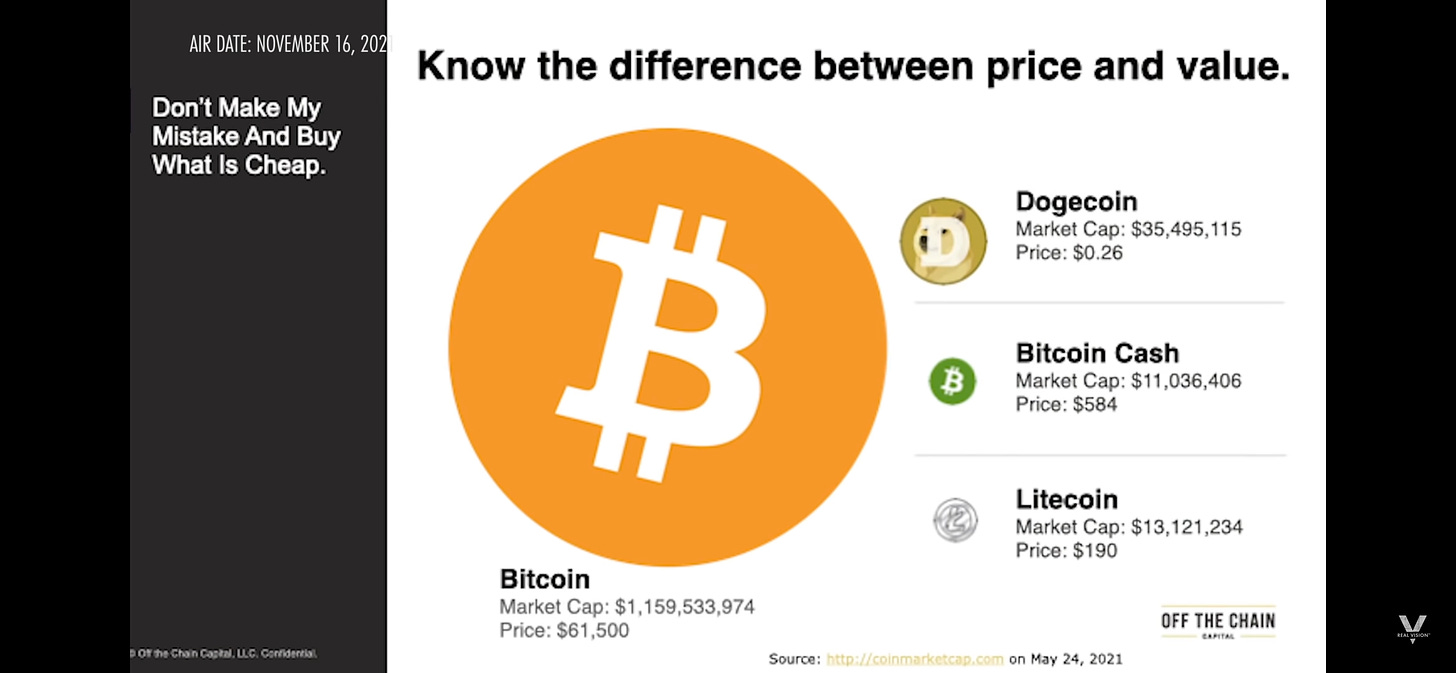

Don’t make the mistake of thinking this is penny stocks and you have to find a crypto that is cheap. That would be the biggest mistake of your life. You can buy fractions of bitcoin and accumulate over time.

There is only one bitcoin, and the safe bet is it will be the only one left in 20+ years because of all the properties that it contains.

No other “crypto” or “alt-coin” contains the properties bitcoin has.

Hence, another reason bitcoins price can continue to rise forever.

All wealth that wants to be stored through time and space is most efficiently done through a thermodynamically sound asset like bitcoin. As more and more people realize they have complete sovereignty and freedom with their wealth through bitcoin and it provides more return than all other asset classes it will continue to moeztize all other asset classes.

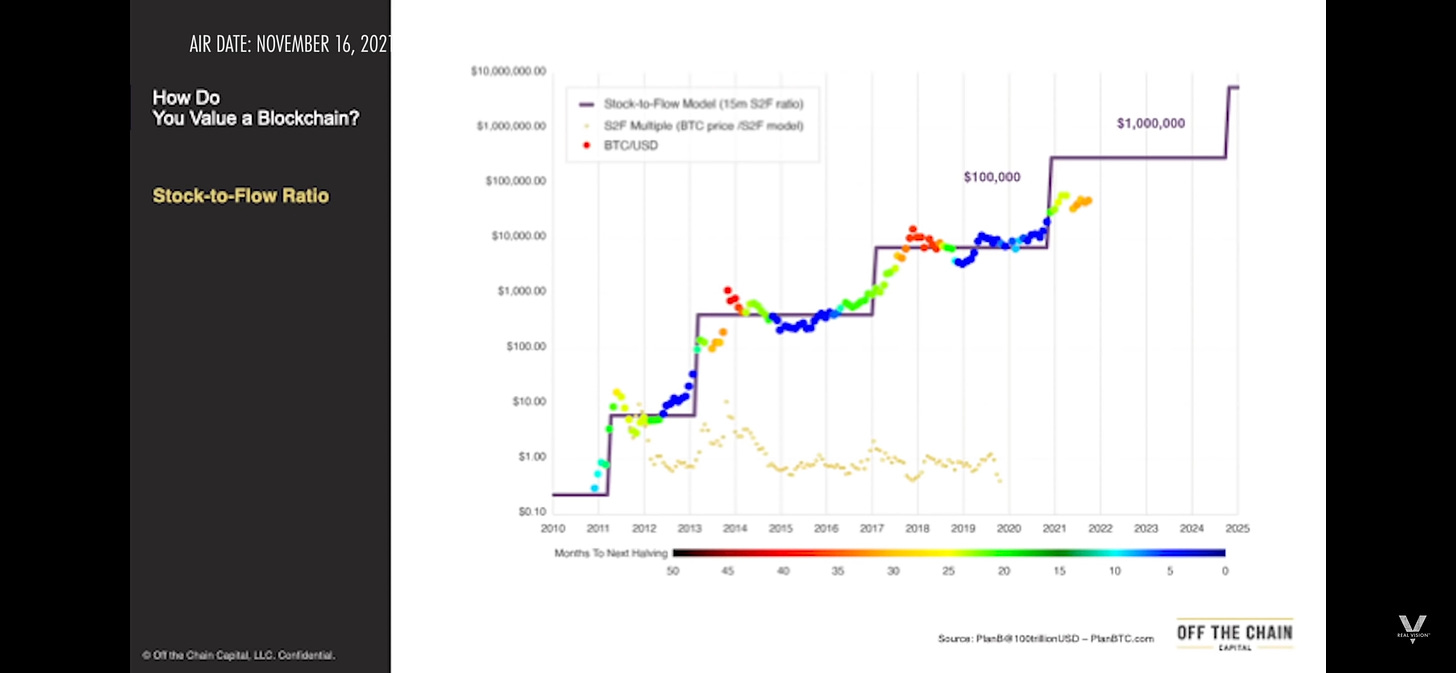

Stock-to-flow model from “PlanB” on twitter. Another model that people will use in the commodity world to see how fair an asset is priced. This was created in order to show where bitcoin is at and where it could go in the coming years through the relative scarcity it contains because of the mining/supply that comes on to the market compared to what is available.

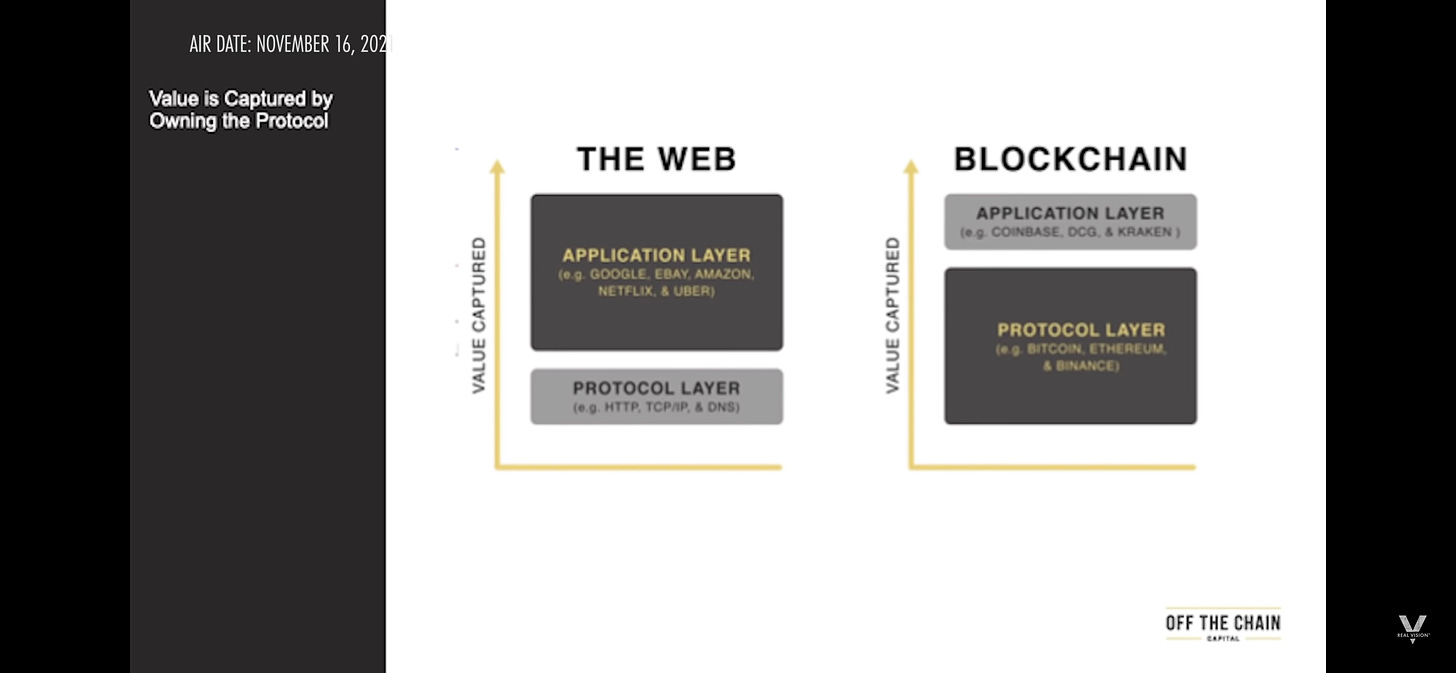

Everyones thinks in terms of companies like Facebook, Twitter, Amazon, and buying the “stock” of these companies. However owning bitcoin is like owning the asset layer underneath those companies. Imagine owning part of the internet those companies are built on?

As Raoul Pal says, “we are in the exponential age of the internet.” The network and the amount of people/nodes/users on that network give something value. If there were only one fax machine in the world it wouldn’t be very valuable until there were more users that came online and joined the network.

This is why Facebook and Amazon continue to grow exponentially because more people created accounts and joined the network. This same effect will take place through the bitcoin network.

Companies now will be built upon the bitcoin network and you can own the underlying layer. As the network grows and attracts more companies, services, and people the value of each bitcoin will continue to grow.

As companies find more ways to utilize the network through privacy concerns, capturing gas flares and turning it in to energy to mine bitcoin, or create frictionless payments with minimal fees, the price of bitcoin will continue to grow.

Ultimately, where can the price go?

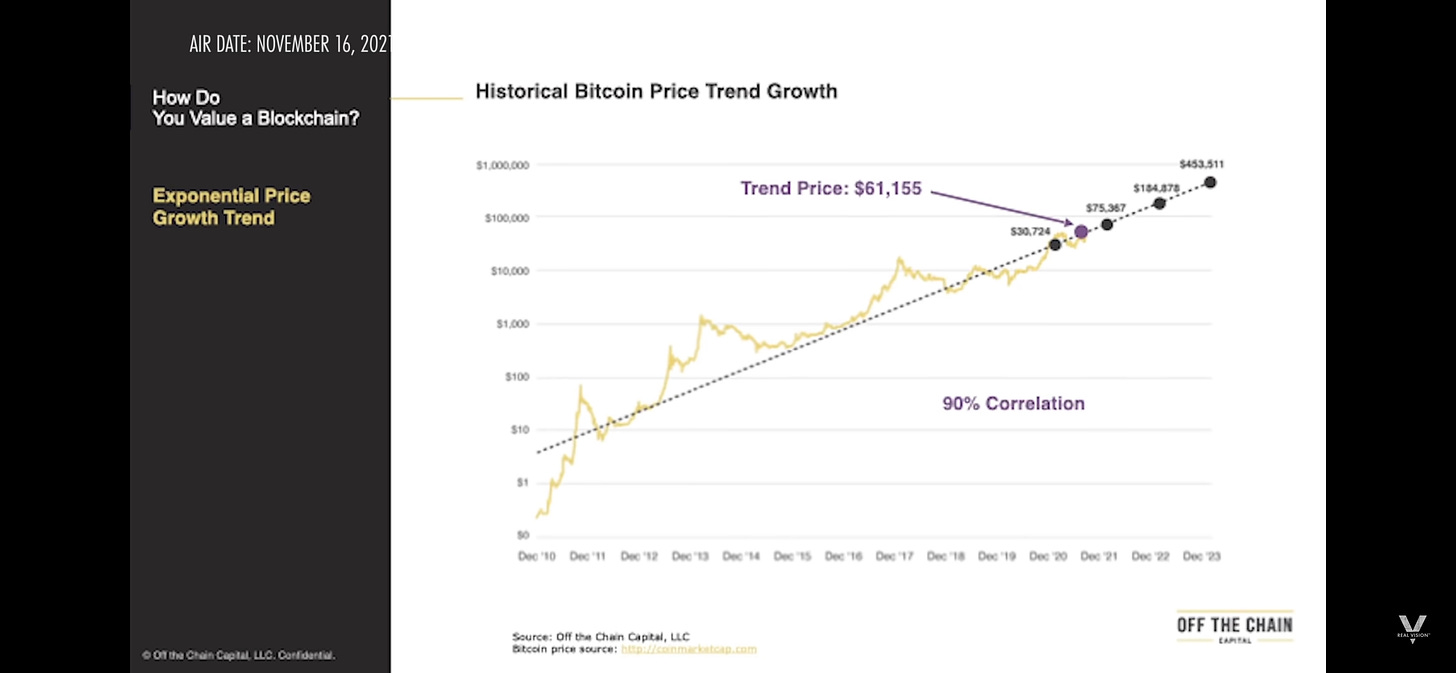

If you see the charts above you see the price of bitcoin going to anywhere from $500,000 to $1 million+ over the next decade.

Greg Foss thinks conservatively $2 million just using math from his experience as bond trader for 30 years.

Michael Saylor thinks the bond market (~ $100T globally) could be completely disrupted and overtaken. Simple math of bitcoin currently sitting below a $1T market cap would be a 100x jump in bitcoin price from here. So current price of around $42,000 for each bitcoin x 100 = $4,200,000/bitcoin.

Or another way of looking at it is $100T market / 21 million total bitcoin = ~$4.8M/bitcoin.

This doesn’t even get in to any of the other markets bitcoin could demonetize over time like gold/silver, stocks, art, real estate, etc..

This isn’t a comprehensive study in all the ways bitcoin can get in to the millions of dollars per coin but more of a thought experiment of where it could be headed.

Hopefully that provided you some things to think about and excitement regarding how investing in the world’s most secure, decentralized, immutable, censorship resistant computer network on the planet could also pay off quite handsomely for you.

Stay strong,

Brandon

Ps. Tomorrow is “bitcoin for dummies” day. I have a litany of courses, books, videos, platforms, info I use to buy, store, and study bitcoin. The rabbit hole is deep, so I hope to provide you a shortcut in the best places to go and get you where you need to be faster.

Bitcoin is hope.

Source link

Author Brandon Gentile