Sometimes we overthink our most pressing problems when in reality the easy answer is right in front of our nose.

The cure for high prices is; high prices, as Peter Schiff astutely notes.

Our central bankers in their infinite wisdom think the cure to slowing or speeding up velocity of currency is to dump more currency units onto the population

A nation’s wealth are the goods and services that it provides or produces.

Not the supply of currency units it dumps everywhere.

Having more currency units chasing the same or fewer goods and services just drives up the price of said goods and services that exist.

Price controls always result in shortages as businesses aren’t able to charge the correct amount, they are the forced to go out of business therefore creating more shortages and yet again higher prices to those that are left.

As the demand increases so does the price. If supply increases then prices go down.

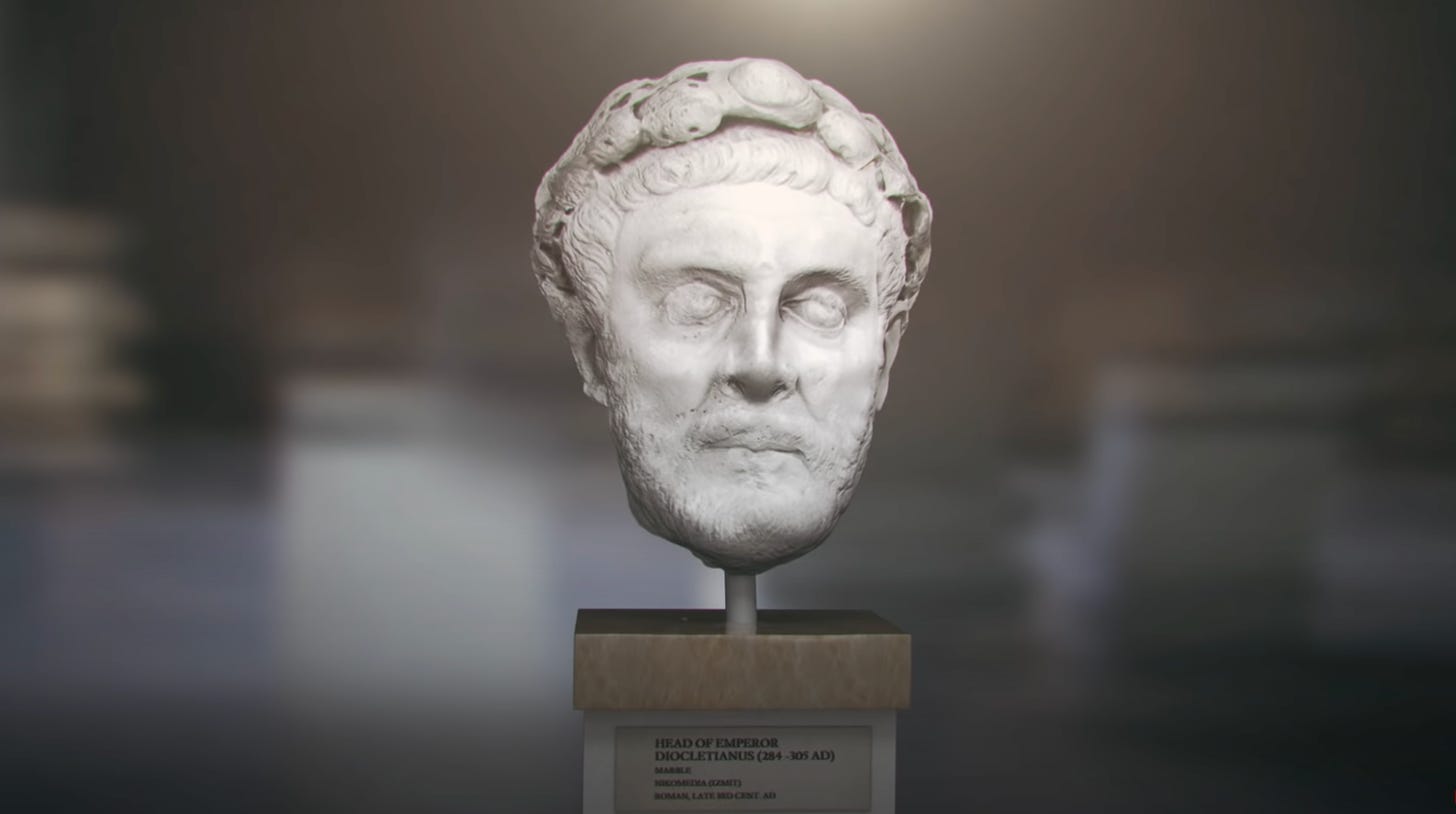

The Roman Emperor Diocletianus tried to impose his will on the free market through price controls as Mike Maloney illustrates in his “Hidden Secrets of Money.”

The arson, Diocletianus, tried to fix his error by dousing the blaze with more gasoline.

People were forced to charge what was set forth through his “edict of prices” (punishable by death) so people stopped working or just changed businesses.

Then government made another law that people had to go into their father’s business and then people just stopped working altogether.

Not following the central authority’s plan was also punishable by death, and so this destroyed and ravaged the entire economy.

What is the cure for supply and demand imbalances?

The cure for demand shortages is bringing the prices down through less currency printing and inflation.

The further every dollar stretches the more people can spend on discretionary items.

The more wealth and purchasing power middle class and poor have to spend on goods and services.

What are shortages and how are they caused by inflation?

Shortages are not just caused by lockdowns and ridiculous government regulations.

They are also caused by central bank printing of currency and loose monetary policy that creates too much fake wealth and leaves too many currency units chasing too few goods and services.

This leaves businesses short of the needed supply if they can’t keep prices climbing to offset the crazy increase in currency being thrown at them.

Monetary policy versus fiscal policy

Because of terrible monetary policy (federal reserve/central banks) printing currency and lowering rates we find ourselves in this situation where people don’t want to save and capital just goes in to the market to be spent while it’s worth something.

The fiscal policy (government) of transfer payments directly to citizens has drastically increased the inflation rate as we have people getting currency units from the government, PPP, or NOT having to make rental, mortgage, or student loan payments.

This fiscal policy leads to more capital chasing an ever decreasing supply goods and services, therefore driving up prices.

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

– Henry Ford

Coupon rate/interest rate help?

A coupon rate is the rate at which you are paid back and how much that payment is.

If we have higher interest rates naturally instead of artificial lower rates from the fed it would slow down the velocity of currency and more capital would be saved earning a better interest.

Because of low rates, the capital that would otherwise be saved is now in circulation wanting to be spent and fighting for the goods and services with all the other currency units.

You know the ramification of that…higher and higher prices.

Recession or depression?

This will lead us to a recession and possible depression.

A recession is officially: “a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters.”

But, you don’t need to have the overlords tell you that we are already in recession. The Fed is trying to crash markets to tame inflation, admittedly:

A officially depression is: “A depression is a severe and prolonged downturn in economic activity. In economics, a depression is commonly defined as an extreme recession that lasts three or more years or which leads to a decline in real gross domestic product (GDP) of at least 10%. in a given year.“

Or as they say, “a recession is when your neighbor loses their job and a depression is when you lose your job.”

This is important because recessions and depressions lead to downsizing of companies which lead to less jobs and less incomes which lead to less investment which then brings about less tax receipts which forces the government print more currency to cover debts, further enslaving the very productive people working in the system..

This collapses everything in on itself in a negative reinforcing loop.

What can YOU do? (Besides voting out crony corrupt leaders and politicians)

At the end of the day all this madness is coming but you can thrive if you own hard assets like:

bitcoin

gold & silver

commodities like oil, uranium, wheat, etc.

guns & ammo

food & water storage (That can be traded and bartered if need be as well..)

Protect yourself and hedge the chaos. Things will be bad for most. But it doesn’t have to be for you or me.

We can survive and thrive in a world gone mad.

Things will get worse before they get better but you can be on the winning side of the trade.

Stay strong,

Brandon

Ps. What else would you like to see us break down?

Source link

Author Brandon Gentile