The game theory dictates that Bitcoin will become a global reserve asset

Some time around 2010 I took a course at the Ben Graham Center for Value Investing at UWO (University of Western Ontario, in London, Canada), taught by the eminent Dr. George Athanassakos. He was the guy who unleashed a shitstorm across corporate Canada and within the corridors the CRA ( Canada’s version of the IRS), when in 2005 he wrote an op-ed in the Globe and Mail on why Bell Canada should convert itself into an income trust. When a company does this, they no longer pay corporate income taxes, and pass income through directly to their unit holders. Doing so would save the mega-conglomerate close to $1B CAD in taxes annually. They decided it was such a good idea they went ahead and announced they would do it. Their rival Telus concurred, actually announcing their conversion even before Bell did. In fact this became somewhat of a trend across boardrooms nationwide.

The political class went ballistic, and it culminated in a tax crackdown on income trusts by the Harper government.

In that course, which was attended by investors as far away as Germany and Japan, I learned two things about conventional finance which completely astounded me at the time. Given the most recent events of this year, the ramifications have finally come home to roost.

The first was an almost off-the-cuff remark by Athanassakos that “all short term debt eventually becomes long term debt”. Being a child of working-class European immigrants, this seemed batshit to me. A prescription for doom. I can’t remember if I mentioned it at the time but I did write it up on an old blog, that debt used to be something you actually paid off.

I referenced a passage from an finance textbook I had from the 40’s, which emphasized the importance of implementing a plan for liquidating debt at the moment it was incurred:

Any corporation, private or governmental, that wishes to provide for a sound and equitable continuity of its business must take steps towards the systematic retirement of debt immediately after it has been incurred. Postponement of all payment for property or priviledges by those who presently enjoy their benefits is calculated to bring uncomfortable consequences to them or those who succeed them.

What happened? August 15th, 1971 happened. The closing of gold convertibility (temporarily) and the birth of the post-Bretton Woods era. From that moment on, debt became perpetual and it had to grow in size. That also meant that interest rates would trend down to the zero bound, and once they got there, they’d effectively be stuck there forever.

The other epiphany from the course was when Dr. Athanassakos was teaching us some intricacies about calculating WACC (cost-of-capital) he referenced the risk-free-rate of interest (textbooks of the day were still using 6%, if you can believe that) and this time I asked, also off-the-cuff (although I believed it on the inside) “What happens when the risk-free-rate is set by an instrument that is no longer risk free?”

He asked me what I meant and I stammered something about unsustainable debt levels, monetary expansion and what if someday the US dollar isn’t regarded as safe enough to be the world reserve currency anymore. Dr. Athanassakos was polite about being dismissive, but I remember getting weird looks from my classmates. From then on I was the class clown.

In hindsight, this institutionalized credulity was understandable. At the time US M2 was only $8T and it had taken an entire decade to double to $16T right before COVID hit.

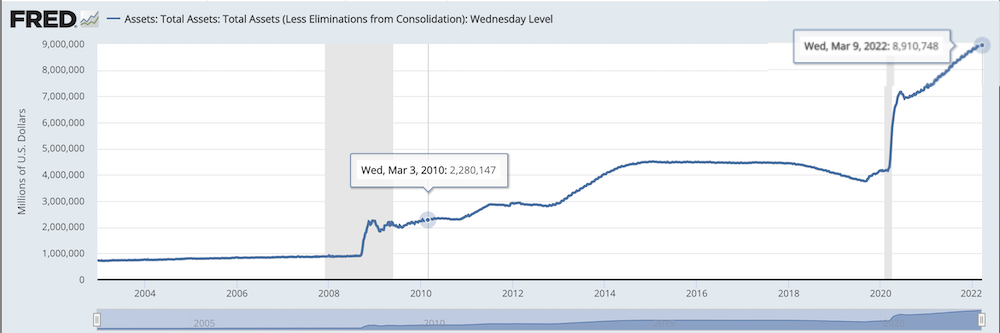

The situation looks a bit more pronounced when you look at the Fed balance sheet:

So maybe I was a little early on the call that this was all headed for uncharted territory.

Bitcoin had been invented by then, but I was still three years away from clueing into it.

Q1 2022 and the End of Trust

When Nixon closed the gold window in 1971, it was an instant in time that forever changed the global monetary order. It commenced the Post-Bretton Woods Era. One where there were no hard-backed national currencies, they would henceforth all float and jockey for position against each other (in many cases, actually incentivized to devalue themselves).

By Q1 2022 I had of course, fully drank the Bitcoin Kool-Aid and continue to do so. In fact, things have changed so radically in the last six weeks that I am now leaning further toward Bitcoin maximalism, where I wasn’t before. Further, where before I was highly skeptical that Bitcoin would ever become a reserve currency, the way I see it now, it’s a lock.

What happened over the past few weeks was nothing less than the end of the Post Bretton Woods era. That’s not me calling it, others have already done that. I’m agreeing with it. Until fairly recently, the end of the USD’s global reserve currency status simply wasn’t something spoken about in polite company. Policy makers have, through their actions, mainstreamed the idea. The risk now is of being unaware that the monetary regime that has been in place for the past fifty years just ended.

Trudeau deputy PM: “Financial service provider will be able to immediately freeze or suspend an account without a court order [if the person supports the truckers]. In doing so, they will be protected against civil liability for actions taken in good faith.” pic.twitter.com/DFzWxkL0dL

— Tom Elliott (@tomselliott) February 14, 2022

(This was the foreshock of the end of the global monetary order)

In the past I viewed Bitcoin as an evolving global “Notgeld”, a German term for “emergency money” that emerged during the Weimer Hyperinflation. As I’d written previously, every hyperinflationary event has its notgeld, whether it’s prepaid phone and gas cards in Zimbabwe, cities printing their own scrip, Venezuelans wrapping gold flakes in worthless Trillion Bolivar banknotes, there’s no end to the ingenuity (and desperation) employed.

My theory was that in an oncoming era where all global currencies were going to hyperinflate simultaneously, Bitcoin would emerge as the global notgeld. And then, I thought, afterwards some kind of global monetary reset would occur. That would probably be some kind of SDR against a basket of hard assets, including gold, but I never imagined that Bitcoin would be a component of that basket.

(To be clear: I still thought Bitcoin would remain important and desirable, especially as a counter-balance against CBDCs that would be inflicted upon the wealthless underclass of the world. But I didn’t think that governments globally would admit a currency that nobody could control to the inner circle.)

Now, all of that has changed

Thanks to Trudeau and Freeland setting precedent that a so-called Western G7 democracy can seize its citizens’ bank accounts with no due process and no appeal for the crime of demanding the reinstatement of their civil rights.

Thanks to the US government seizing the foreign reserves of another country (Afghanistan), not to freeze them until such time as democracy returns, but to actually redistribute them to their own citizens. Those funds were the savings of ordinary Afghan citizens who live under the Taliban, not as part of them.

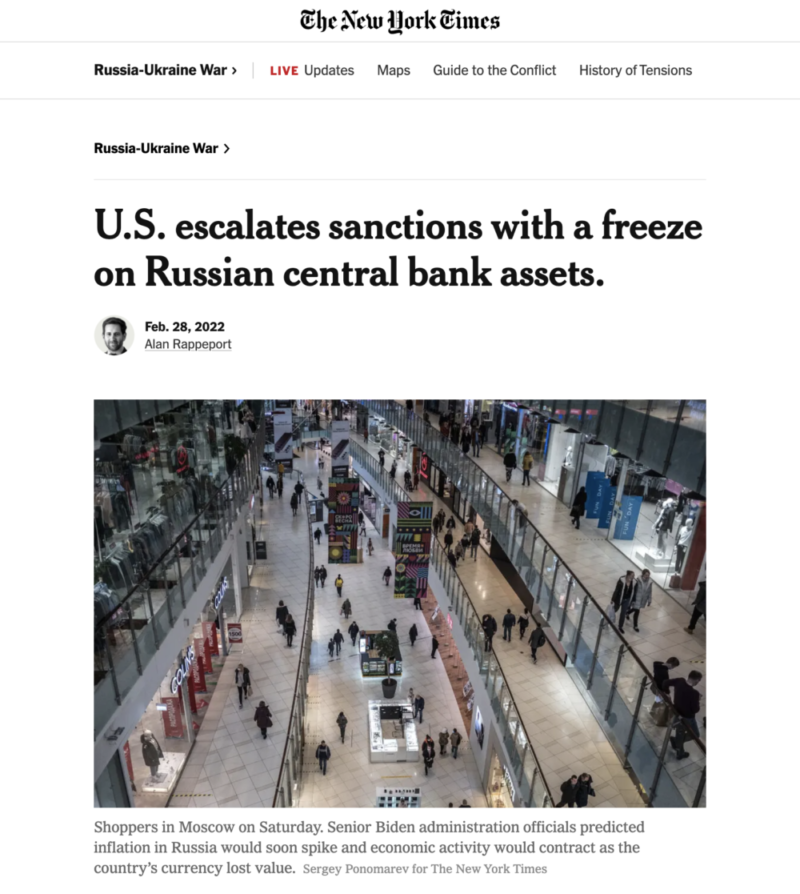

And finally, thanks to the widespread weaponization of the SWIFT payment system against Russia, the seizure of Russia’s foreign reserves (approximately 100X the amount of Afghanistan’s), not to mention Russia’s implementation of capital controls against its own citizens (again, the ordinary citizens coming up on the short end of the stick).

We have experienced a rapid sequence of events that have forever altered the monetary, financial landscape globally, to wit:

- Citizens can’t trust their own governments to protect their property rights, and

- Governments can no longer trust each other to respect each other’s currency reserves

What we have here is the realization that absolutely no one can be trusted as a third-party intermediary for capital. There is really only one alternative to this situation: that is the mass adoption of a trustless, frictionless digital bearer instrument that can be accessed by everybody, everywhere, no matter what.

And that is Bitcoin.

The original idea of hyperbitcoinization was defined as:

“the inflection point at which Bitcoin becomes the default value system of the world. As more individuals and groups around the world realize the advantages of a borderless, censorship-resistant and natively digital system for transacting value, a critical mass of users will eventually fuel currency demonetization and the replacement of our world’s ingrained financial institutions and world powers with a more equitable, publicly-driven system.”

When I think of it, Bitcoin doesn’t necessarily need to achieve the status of being the default value system of the world. Whatever comes next, I’m sure it will include gold for example. But as I’ve always said, gold and Bitcoin bring different advantages to the same problem.

It’s Bitcoin’s unassailable mobility that make it such a necessary ingredient to the coming era of hard-backed and zero counter-party reserves. People wanting to fund resistance in Ukraine right now are sending Bitcoin, not gold. The Ukraine had already spirited their gold reserves out of the country during the 2014 invasion. (Hopefully they don’t wind up with a government the US dislikes, or those reserves will be gone.)

So while Bitcoin is now at the point where it can fund arming the resistance in The Ukraine, it’s been pointed out that contrary to the histrionics of some policy-makers, it is still too small to help a country like Russia to evade sanctions. That means in order to take its place among the new set of neutral reserve assets that are usable to sovereigns wanting to defend their wealth, things like Bitcoin (and gold) will have to reprice dramatically in fiat terms.

I made my call in 2010 and looked like a clown making it: the USD would not remain risk-free forever.

I’ll make another one now since I’m used to looking crazy: when Bitcoin does reprice into its role as a global reserve asset, we aren’t going to be thinking of it in terms of BTC anymore. We’re going to be obsessing over if/when/buts of USD/satoshi parity.

Welcome to the Post-Post-Bretton Woods era, where third party custody of your wealth is a gun pointed at your head. Recall the old maxim about trust: once it’s gone, it can be near impossible to regain.

This is now true of the entire global financial system as well as the governments and institutions that prop it up.

The world is undergoing a monetary regime change. Get the Crypto Capitalist Manifesto free, when you join the Bombthrower mailing list or try our premium research service for crypto investors here.

Source link

Author Mark E. Jeftovic