The Bitcoin and crypto crash we have seen this week is an unbelievable buying opportunity that has been gifted to us.

When you know what you are holding, you go in, and buy more of it.

For some reason people will see a sale for tires at the repair shop or for meat at the store or for diapers on Amazon and they will rush in to stack up and buy more of it while they can.

However, in the investment market, when there’s homes for sale, stocks, or pristine digital collateral assets like Bitcoin, people tend to all get in a herd mentality and run out of the building burning together.

The term “fire sale” comes from when there’s carnage in the streets. And smart money goes in and buys up all the assets for pennies on the dollar.

Everybody knows to “buy low and sell high,” yet very few do because emotions and lack of education get in the way.

Famed investor Jim Rogers says, “If you want to be a great investor, then you need to know history and you need to know philosophy. I want to sell when there’s hysteria and buy when there is panic.”

Bitcoin holds properties that no other asset does; it is immutable, un-censorable, trust-less, un-confiscatable, decentralized, and permission-less.

No one can take it from you and you could even leave this planet with 12 or 24 words in your head and have an infinite amount of wealth on you.

You can’t do that with jewelry, gold, silver, stocks, businesses, or real estate.

Not to mention all the other aspects of freedom that Bitcoin helps push forward for humanity.

Banking people who have no financial track record.

Cleaning up the environment through mining and using captured energy.

A network that accrues value instead of leaking value through inflation in fiat currencies (dollar, yen, peso, etc..)

Removing rent-seekers and toll booths taking fees at every turn.

People that own and transact peer to peer instead of centralized hubs who might not have good intentions owning the hubs.

The fiasco that has played out over the past week with Terra Luna is probably one of the biggest selling points for Bitcoin.

Bitcoin has no leader, no figurehead, and no marketing team. There is no one that any government or sovereign can target and take down and kill the movement. It is a mind virus for good that is spreading throughout the planet.

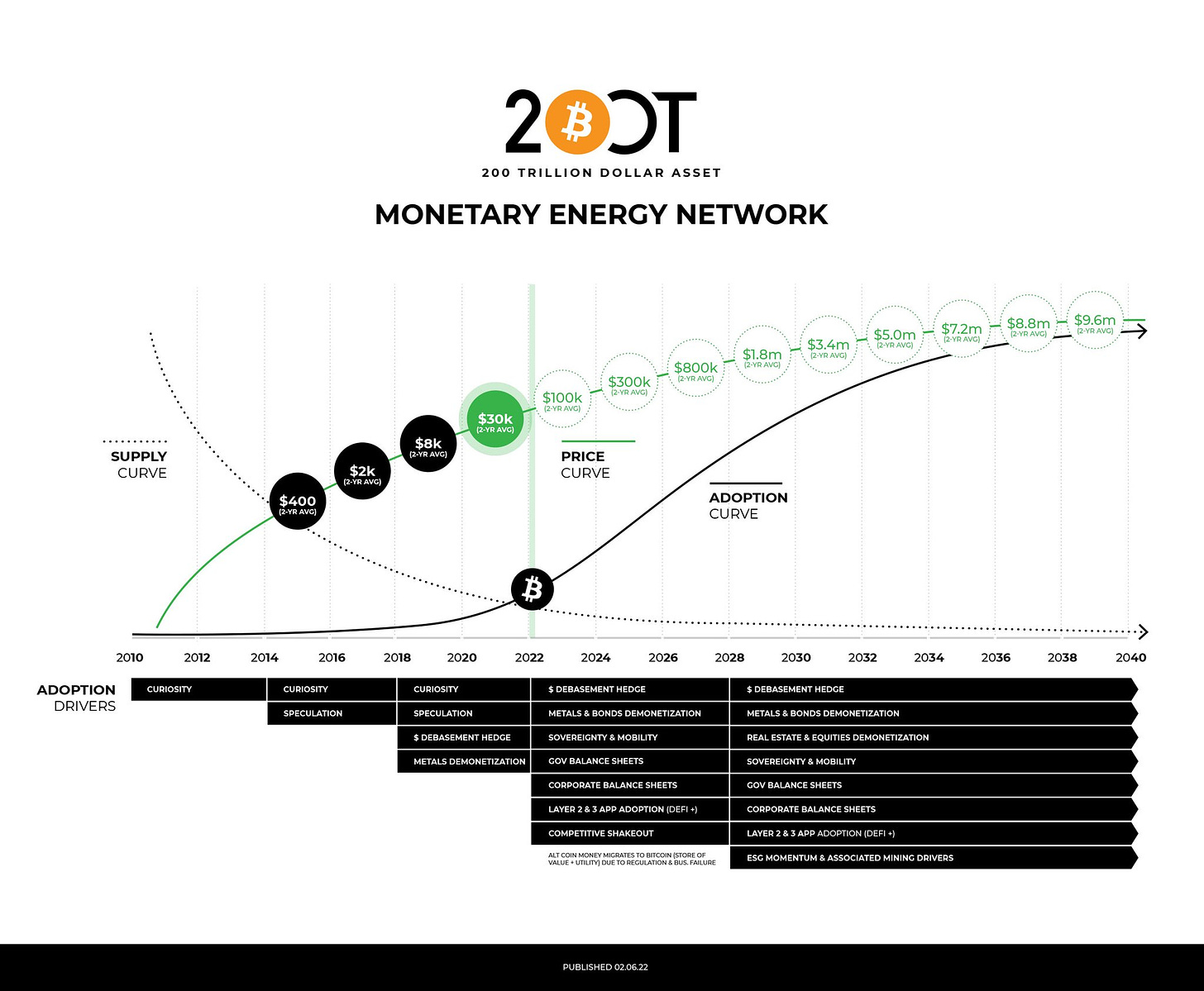

This is why it continually crews value at 100-200% cumulative average growth rate each year.

No other cryptocurrency contains bitcoins properties. Hence, why they are all built on shaky ground. They are venture capital speculative plays, period.

Governmental agencies have even said as much and there’s even rumors that the government was potentially in on trying to attack this stablecoin to make an example out of it, and to give themselves the ability to come in and bring regulations to stablecoins.

The arson becomes the firefighter.

Now, we have no evidence that this is true. Just rumors. However, would it shock anybody as this aligns perfectly with government’s incentives?

Again, this is why you must know what you’re holding and only invest in things you understand.

Get your bitcoin off of exchanges and put it in your cold storage wallet and then keep it safe.

This could all be avoided if people had patience and they continued to build their projects on the Bitcoin blockchain instead of going off on their own trying to mess with already perfect money.

Bitcoin only.

Our job here is to create safety and security for ourselves while also outperforming the market over the next decade or two period. It’s a lofty goal, but it can be done.

Remember, the more independent we are the less we are dependent on government and those around us.

The less that people are voting for gimmie/stimmies from the government, the less destruction of future generations prosperity through bigger and bigger debt burdens.

The sneaky secret in all of that is; who audits those handouts?

The money rarely gets where it needs to go when it comes to government boondoggles and claptraps.

Just the way they like it. When its shrouded under opaque massive legislation creating the “lack of transparency the government loves,” as Obama’s healthcare czar said, then that’s how you get “10% going to the big guy.”

This is how politicians go in to “public service” and come out multi-millionaires. (That and becoming lobbyists and walking straight in to the board rooms of Fortune 500 companies right after their “public service” is over with.)

This is what the people can feel; a boiling over of emotions of “where did our wealth go” and “who is taking it from us?”

A slow building boil.

That tea pot is about to start screaming…

However, abundance can be ours if we allow it.

When life and government runs on the bitcoin blockchain we will be able to quickly and easily audit where our wealth is going and bad actors will be eradicated out of the system.

Light is the best disinfectant.

More to come on less privacy equaling more freedom…

Stay strong,

Brandon

Ps. Fed chair Jay Powell just stated that they got inflation really wrong and should have hiked rates way sooner. So much for the “transitory” inflation. How come they were the only ones who thought that? We all knew….more to come.

Source link

Author Brandon Gentile