I actually had a post about abandoned building planned for today but the CPI numbers are very hot so I wanted to deal with them because realistically, inflation and economic problems are the most common disasters you need to prep for.

So first – Let’s remind ourselves of what CPI is:

The Consumer Price Index (CPI) measures the monthly change in prices paid by U.S. consumers. The Bureau of Labor Statistics (BLS) calculates the CPI as a weighted average of prices for a basket of goods and services representative of aggregate U.S. consumer spending.

The CPI is one of the most popular measures of inflation and deflation. The CPI report uses a different survey methodology, prices sample and index weights than the producer price index (PPI), which measures change in the prices received by U.S. producers of goods and services.

So it’s one measurement of some goods the government thinks represents the average needs of you – the consumer. If you want more minutia about the numbers:

The BLS collects about 94,000 prices monthly from some 23,000 retail and service establishments. Although the two CPI indexes calculated from the data both contain the word urban, the more broad-based and widely cited of the two covers 93% of the U.S. population.

Shelter category prices accounting for nearly a third of the overall CPI are based on a survey of rental prices for 43,000 housing units, which is then used to calculate the rise in rental prices as well as owners’ equivalents. The owners’ equivalent category models the rent equivalent for owner-occupied housing to properly reflect housing costs’ share of consumer spending. User fees and sales or excise taxes are included, while income taxes and the prices of investments such as stocks, bonds, or life insurance policies are not part of the CPI.

Still awake. OK basically CPI surveys a bunch of stores and apartment managers and such to see how much prices are going up on a bunch of stuff. If you were up early yesterday mourning (like I was) you watched this news:

When I was a political blogger when had a joke that when something the government pretended to be shocked about something we’d write unexpectedly in italics. This is how you should read “hotter than expected” nowadays. Only propagandists thought the CPI would be lower.

The government and the Federal Reserve has been “fighting” inflation for months to no avail:

Market experts on Twitter reacted to the “troubling” news that the inflation rate was higher than predicted Thursday.

The Department of Labor released its consumer price index (CPI) report for the month of September and at 8.2% year over year, the price increase was 0.4% higher than it was last month. The American middle class is feeling the pain caused by their reduced purchasing power.

Peter Schiff, CEO of Euro Pacific Capital Inc., contended that as bad as the CPI reports have been in recent months, it does not represent the true severity of inflation.

“Another hotter than expected #CPI surprised investors. Sept. CPI rose .4%, double expectations. YoY prices rose 8.2%. The 6.6% YoY rise in core CPI is the most since 1982. OER had biggest monthly spike since 1990. The #Fed is losing its #inflation fight. Soon it will surrender.”

A recent Gallup survey found that inflation is causing economic hardship for 56% of Americans and various polls have revealed inflation to be a top issue heading into the 2022 midterm elections.

When they say surrender many think they mean interest rates will go way up. Get out of debt.

Inflation is probably worse than what CPI and PPI report. I don’t want to get into the long politically charged discussion of who is right on this but many people suggest the government purposefully picks a basket of goods that inflates slowly so the inflation number looks better. Those people often quote a site called Shadow Stats (which was down as of this writing) but the guy who runs it has been saying inflation is at double digits for a while now:

He gets to that number by using the “old” calculations the government used before the 1980s. It’s an interesting metric.

But what does all this actually mean? Graphics via Fox Business. First meat prices;

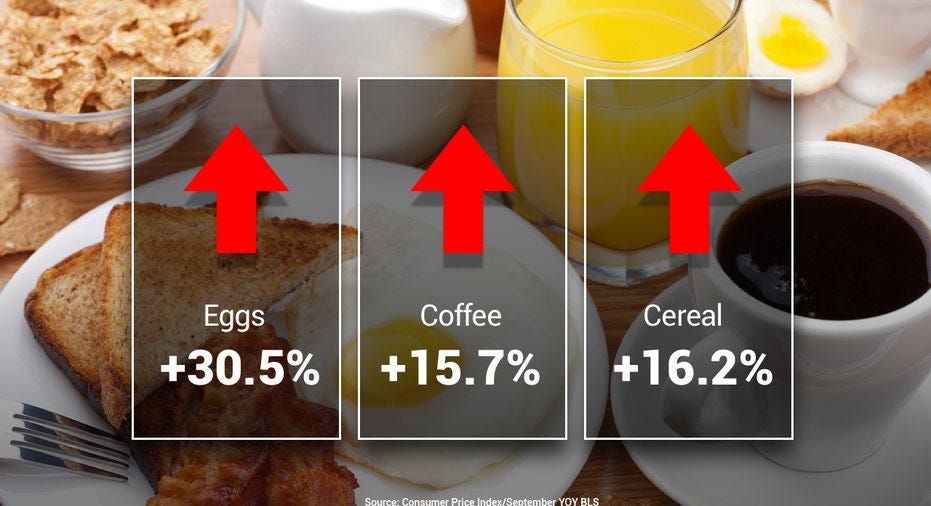

And breakfast goods:

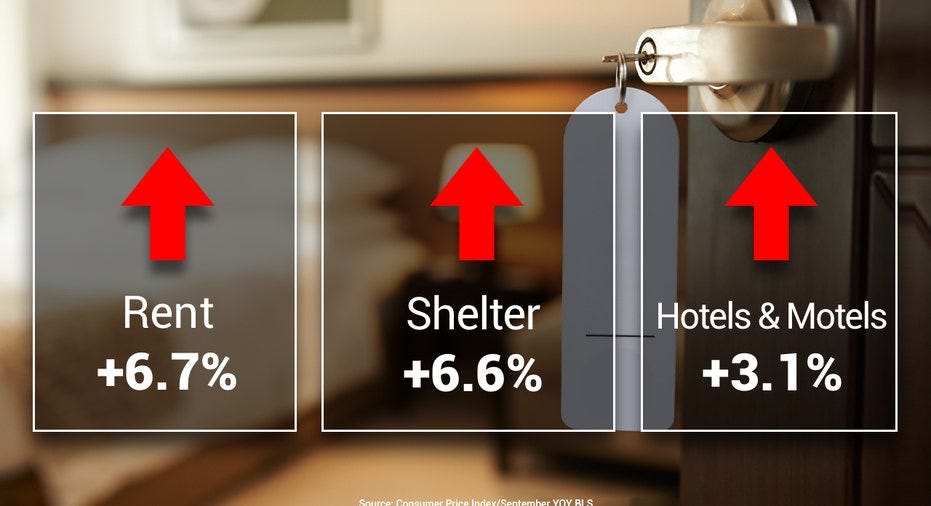

And shelter:

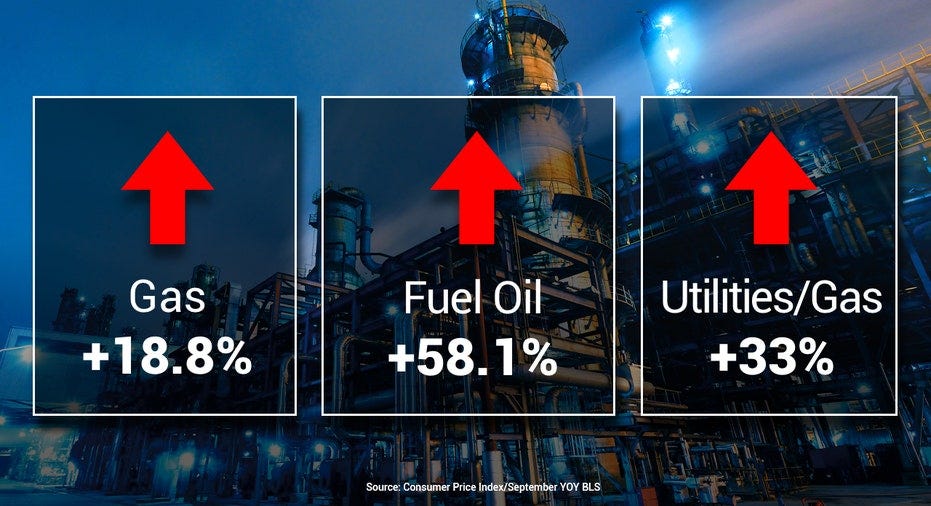

And the big on you’re going to really feel in the next few months – energy:

That fuel oil increase will be a big deal in the Northeast and Midwest. Start learning how to keep warm with less heat. Blankets and sweaters are on the shopping list.

So what do you need to do here?

Basic home economics. You’re going to have to cut expenses where you can to pay for higher utilities and food. Period.

Because I started this newsletter partly because I knew people who were not of my political persuasion who were interested in prepping I try not to be heavy handed here but – people did vote for this. Last cycle people ran on the idea energy was too cheap and you shouldn’t eat meat and eggs and they followed through on their promises to reduce your consumption. Just something to think about next cycle.

If you have extra money laying around US treasuries are at historic highs (something like 4%) and as I’ve mentioned before there is a I Bond that pays about 10% per year. CD rates are also going up averaging about 3-4% for good ones.

You’ll notice that most financial instruments will not keep up with inflation. These are defensive plays to slow the drain on your assets. Inflation makes everyone poor so the gal is to slow down the race to poverty.

Front load purchases you can now as things are just getting more expensive. If you have freezer space and see a deal on meat stock up. If you have room for bags of rice buy it now. Take your Starbucks budget and use that to pay down debt.

This will be a very painful few years unless something changes so start preparing for some lean times.

https://www.instagram.com/oldtimeypistolero/

Source link

Author Rob Taylor