Bigger Government Means Less Prosperity

May 17, 2022 by Dan Mitchell

When I first started writing this daily column, the Congressional Budget Office was infamous for dodgy economics.

That was the bad news.

The good news is that CBO is more of a mainstream organization today.

It’s far from being libertarian, to be sure, but it no longer seems to have the left-leaning bias that plagued the bureaucracy in the past (it had gotten so bad that I advised Republicans not to cite CBO numbers even when they seemed helpful to the cause of less government).

For instance, I grudgingly acknowledged a few years ago that CBO was better (but still not good) when analyzing potential repeal of Obamacare.

And I was actually impressed last year when CBO published a report showing that a bigger burden of government spending would reduce growth.

And now we have another report that reaches similar conclusions.

The new study, released last month, considers what would happen if lawmakers decided to control red ink by either raising taxes of by restraining spending.

A perpetually rising debt-to-GDP ratio is unsustainable over the long term because financing deficits and servicing the debt would consume an ever-growing proportion of the nation’s income. In this report, CBO analyzes the effects of measures that policymakers could take to prevent debt as a percentage of GDP from continuing to climb. Policymakers could restrain the growth of spending, raise revenues, or pursue some combination of those two approaches. …or this analysis, CBO examined two simplified policies. The first would raise federal tax rates on different types of income proportionally. The second would cut spending for certain government benefit programs—mostly for Social Security, Medicare, and Medicaid. Under each of the two stylized policy options, debt as a percentage of GDP would be fully stabilized 10 years after the changes were implemented.

By the way, I would have greatly preferred if CBO estimated the impact of genuine entitlement reforms.

Trimming spending for existing programs is better than nothing, of course, but the goal should be to achieve both structural reforms and budgetary savings.

But I’m digressing. Let’s get back to what was actually in the report. Here’s what CBO projects if policy makers choose to raise taxes.

…the higher tax rates that would be required if implementation of the policy was delayed would reduce after-tax wages, which would discourage work and lower the aggregate supply of labor. Those reductions in capital stock and the labor supply would cause GDP to be lower… As a result, GDP would be 0.9 percent lower in 2051 if implementation of the policy was delayed by 5 years and 2.6 percent lower if it was delayed by 10 years.

And here’s what happens if they decide to trim benefits.

…a drop in benefits would reduce people’s income and induce some people to work more to, at least partially, maintain their standard of living, thereby increasing the aggregate labor supply. …a drop in expected future retirement benefits would induce workers to save more before they retired, and that increased saving would, in turn, increase the aggregate capital stock.

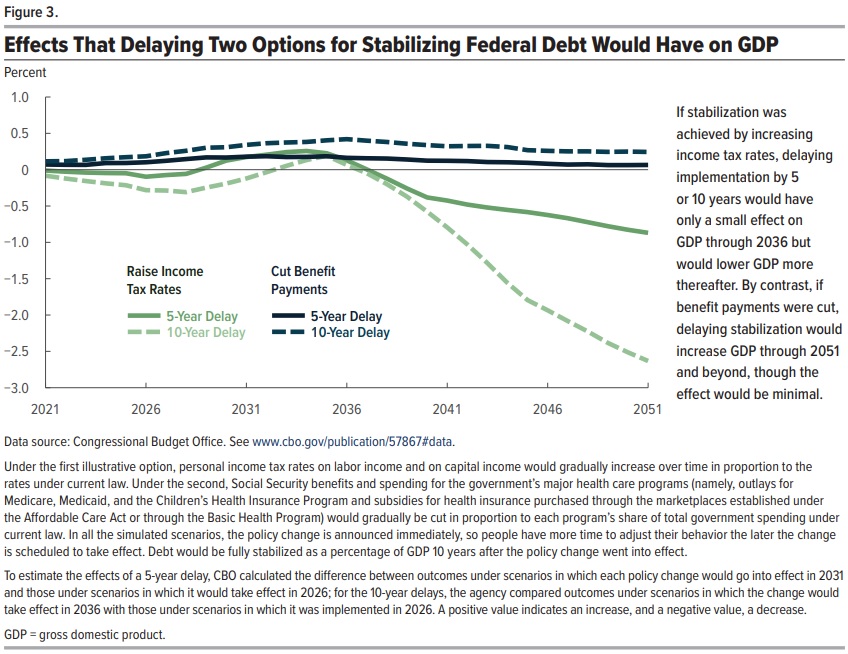

Figure 3 from the report allows readers to compare how the different options affect the economy’s output.

In other words, we get lower living standards if taxes go up and higher living standards if spending is restrained.

How big is the difference? As you can see, the tax increase options (light green) cause significant long-run reductions in gross domestic product.

Trimming benefits by contrast (the dark green lines) actually lead to a slight increase in economic output.

The report accurately explains why the two policy choices produce such different results.

…GDP would be lower after an increase in income tax rates than it would be after cuts in benefit payments… Whereas benefit cuts strengthen people’s incentives to work and save, tax increases weaken those incentives and thus reduce the capital stock, the labor supply, and output.

In other words, it’s not a good idea to copy nations such as France, Italy, and Greece.

Which is a good description of Biden’s so-called plan to Build Back Better.

Source link

Author Dan Mitchell