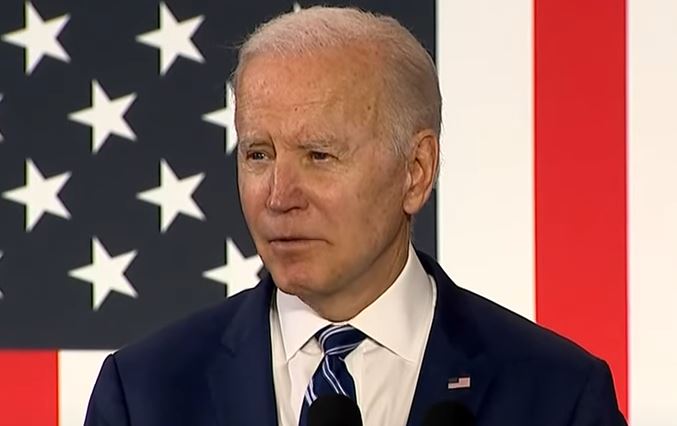

President Biden used Tax Day to contrast his plan to cut taxes for people making less than $400,000 versus the GOP plan to raise taxes on the middle class.

According to a fact sheet provided to PoliticusUSA by the White House:

This Tax Day, the difference in approach between the President and Congressional Republicans couldn’t be clearer. The President is fighting for tax cuts for the middle class and to ensure that the super wealthy and large corporations pay their fair share, while Congressional Republicans, led by Senator Scott, are proposing big tax increases on middle-class families.

President Biden’s plan would give tax relief to tens of millions of families—continuing the tax relief families are seeing this Tax Day—and he’d apply new minimum taxes on billionaires and large corporations to make sure they’re paying their fair share. He wouldn’t raise taxes by a penny on anyone making less than $400,000.

In contrast, Congressional Republicans would continue the big handouts they’ve given to the richest Americans and largest corporations and implement a Middle-Class Tax Increase. Congressional Republicans’ plan will increase middle-class families’ taxes an average of nearly $1,500 this year alone and take $100 billion out of the hands of middle-class families each year.

Not only that – but the Republican plan would eliminate Social Security and Medicare. The President believes we have a sacred commitment to our nation’s seniors, while the Republican plan puts that at risk.

The President’s Tax Plan Ensures That Corporations and Billionaires Pay Their Fair Share and Delivers Tax Relief to Middle-Class Families

In recent years, both billionaires and the largest corporations have paid an average tax rate of just 8 percent. That’s less than what a teacher and firefighter can pay. The President’s plan would fix that, and give middle-class families the tax relief they deserve.

President Biden is calling on Congress to pass legislation requiring the wealthiest American households to pay a minimum of 20 percent on all of their income, including unrealized investment income that currently is untaxed. The richest Americans could no longer do what they can now—and often pay no tax whatsoever or very little tax on their income and too often escape paying income tax forever. The tax will apply only to the top one-one hundredth of one percent (0.01%) of American households — those worth over $100 million, and over half of hundreds of billions raised would come from households worth more than $1 billion.

The President has also proposed repealing the 2017 Republican tax giveaways for the wealthiest Americans by restoring the top income tax rate for those making more than $400,000.

The President believes that profitable corporations shouldn’t pay a lower tax bill than a middle-class family, and shouldn’t be able to avoid taxes by shipping jobs and profits overseas. The President is championing a 15 percent corporate minimum tax here and around the world to ensure that no large profitable corporation gets away with paying $0 in taxes and reversing the massive 2017 Republican tax cuts, by increasing the corporate tax rate to 28 percent.

And, the President is fighting for continued middle-class tax relief, especially as the middle class and working people deal with global inflation. Because of the American Rescue Plan, millions of middle-class families are receiving well deserved tax cuts through the Child Tax Credit, the Earned Income Tax Credit, Affordable Care Act Premium Tax Credits, and the Child and Dependent Care Tax Credit. Families are benefitting from these tax cuts right now as they file their taxes on this Tax Day. The President is proposing extending that tax relief because he believes that middle-class families already pay enough in taxes.

Republican Middle-Class Tax Increase and Threat to Social Security and Medicare

After delivering almost $2 trillion in tax cuts for the wealthiest Americans and largest corporations with their 2017 tax law, Congressional Republicans, led by Senator Rick Scott, are following up by proposing $100 billion per year in tax increases on middle-class families. According to independent analysis, around 75 million American families—96 percent of them making less than $100,000—would pay an average of $1,480 more in taxes each year. The Republican plan doesn’t raise a single penny in taxes from the wealthiest Americans or profitable corporations.

These tax increases would mean:

- 24 million families of seniors making less than $100,000 per year would face tax increases.

- Another 24 million families with kids making less than $100,000 per year would face tax increases.

In 2017 the Republicans delivered an average tax cut of over $250,000 a year to families in the top .1%; now they want working families to pay $100 billion more in taxes each year. Republicans complain that middle-class Americans don’t have “skin in the game” and don’t pay enough in taxes. But the truth is that middle-class Americans are the back bone of our economy, pay plenty in federal, state, and local taxes, and in many cases pay a higher rate than the super-wealthy.

It’s not just that – the Republican plan calls for expiring all laws, including Social Security and Medicare, after 5 years. That means Social Security and Medicare would be eliminated, unless Congress could enact them again. That’s wrong. The President believes these programs are sacred commitments. They should be strengthened – not threatened.

The Choice Is Clear

This Tax Day, it’s a clear choice. And the President is going to continue fighting for middle-class tax relief and to make sure the richest Americans and largest corporations don’t pay a lower rate than middle-class families. And he will fight against the Republican plan to raise taxes on middle-class families and to threaten the future of Social Security and Medicare, while continuing giant hand outs to very top and the largest corporations.

Biden is using Tax Day to explain to the American people what is on the line. Unlike Trump, Biden doesn’t need to be defensive, because he releases all of his tax returns. For Biden, Tax Day is an opportunity to remind the vast majority of taxpayers that Democrats want to cut their taxes, while Republicans want to raise them.

Mr. Easley is the managing editor. He is also a White House Press Pool and a Congressional correspondent for PoliticusUSA. Jason has a Bachelor’s Degree in Political Science. His graduate work focused on public policy, with a specialization in social reform movements.

Awards and Professional Memberships

Member of the Society of Professional Journalists and The American Political Science Association